Slingshot has been investing in startups since 2012.

Over the past decade, we’ve managed multiple funds, backed over 150 companies, and built industry relationships across a wide range of sectors. Like most VCs, our portfolio metrics are strong on paper, but liquidity has taken longer than expected, driven by market dynamics now well understood & supported by third party credible research.

In the last 12 months, we’ve actively and deliberately executed exits across our portfolio to deliver returns to our investors. This has required patience, alignment between buyer & seller (particularly price), and a willingness to do the hard work behind the scenes.

Through multiple cycles and refinements, we’ve reduced friction, shortened the time period, and introduced aligned new shareholders to companies we believe in.

We're now offering this capability to other investors looking to unlock liquidity through secondary transactions.

We are grounded in the same three pillars that have defined Slingshot since day one: People, Network, and Process.

People

We’ve been in the ecosystem for over a decade, and we’ve stayed close to the teams, operators, and founders who built it.

Slingshot is led by Trent and Craig, backed by a team who’ve worked together across funds, deals, and company journeys. We know how to put deals together and more importantly, how to get them done.

Every transaction has a dedicated deal lead from our side. That means real accountability, consistent communication, and clear ownership from start to finish.

Craig Lambert

Craig Lambert

Founding Partner. Operator turned investor with two decades of experience across venture and growth-stage companies.

Amar Kashyap

Amar Kashyap

Investment Manager. Background in VC, strategy, and execution across early-stage transactions.

Network

Our investor network spans active Corporates, VCs, angels, and family offices across Australia and abroad. Many corporates are looking for later-stage exposure but don’t have the internal infrastructure to identify or execute these types of deals. They trust us to bridge that gap.

Our investors have worked with us before. They know we bring clean, credible transactions and they know we’ll run them properly.

We match opportunities with buyers who are aligned and ready to move. We don’t spray deals (unlike corporate advisers).

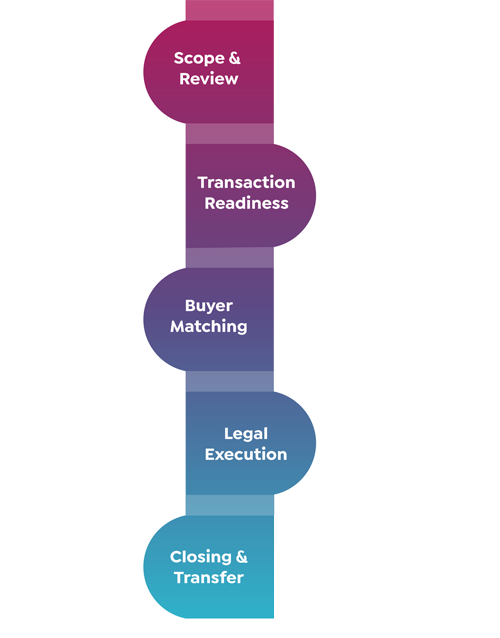

Process

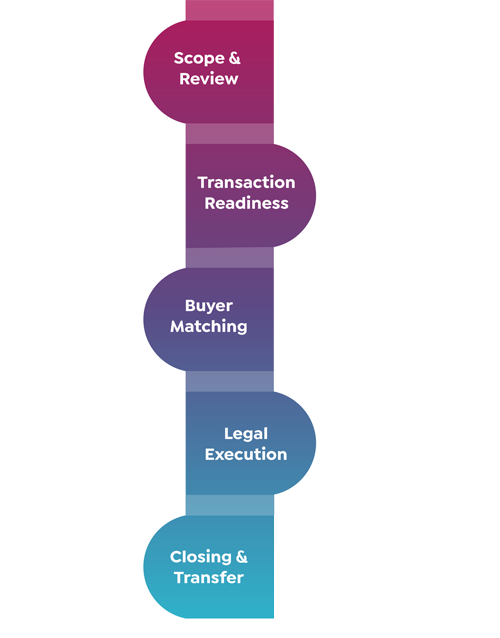

Secondary transactions are more complex than they first appear. There are legal steps, timing pressure, investor restrictions, multiple stakeholders, and without structure momentum slips.

We run every deal against a clear execution plan typically timeboxed to eight weeks. Everyone involved knows where they stand and what’s needed next.

We’re not learning this as we go. We’ve built playbooks that work.

People

We’ve been in the ecosystem for over a decade, and we’ve stayed close to the teams, operators, and founders who built it.

Slingshot is led by Trent and Craig, backed by a team who’ve worked together across funds, deals, and company journeys. We know how to put deals together and more importantly, how to get them done.

Every transaction has a dedicated deal lead from our side. That means real accountability, consistent communication, and clear ownership from start to finish.

Craig Lambert

Craig Lambert

Founding Partner. Operator turned investor with two decades of experience across venture and growth-stage companies.

Trent Bagnall

Trent Bagnall

Founding Partner. Former founder, investor, and ecosystem builder with a background in corporate finance.

Amar Kashyap

Amar Kashyap

Investment Manager. Background in VC, strategy, and execution across early-stage transactions.

Brett Thomas

Brett Thomas

Advisor. Experienced COO with deep operational expertise across high-growth businesses.

Steph Hinds

Steph Hinds

Advisor. Founder and strategic finance partner with deep expertise in startup capital structuring and compliance.

Network

Our investor network spans active Corporates, VCs, angels, and family offices across Australia and abroad. Many corporates are looking for later-stage exposure but don’t have the internal infrastructure to identify or execute these types of deals. They trust us to bridge that gap.

Our investors have worked with us before. They know we bring clean, credible transactions and they know we’ll run them properly.

We match opportunities with buyers who are aligned and ready to move. We don’t spray deals (unlike corporate advisers).

Process

Secondary transactions are more complex than they first appear. There are legal steps, timing pressure, investor restrictions, multiple stakeholders, and without structure momentum slips.

We run every deal against a clear execution plan typically timeboxed to eight weeks. Everyone involved knows where they stand and what’s needed next.

We’re not learning this as we go. We’ve built playbooks that work.

FAQs

Whether you're an investor or a founder/early team member, we help you explore secondary transactions to unlock liquidity.

For more information contact craig@slingshotters.com